A Limited Liability Partnership or LLP is an increasingly popular partnership structure in Connecticut for professionals and other partners who wish to have more flexibility coupled with added protection against liability. A Connecticut Limited Liability Partnership allows partners to work together while mitigating personal liability for certain business debts. Most professionals (including consulting firms and service firms) who like to collaborate but are not willing to take too much risk choose this structure.

In Connecticut, general partnerships involve their partners’ liability to the business debts and behavior of the partners. LLP provides statutory protection to the partners and gives ease of management like a partnership. Partnering provides control over daily operations and a level of protection not offered in ordinary partnerships.

This guide will explain the Connecticut Limited Liability Partnership. It covers its operation, reasons for business adoption and comparison with other entity options. You’ll find practical guidance on whether an LLP best for your clients or not. A Connecticut Limited Liability Partnership allows for growth, compliance, and longevity – all of which we’ll explore as a group.

Understanding the Connecticut Limited Liability Partnership

A Connecticut Limited Liability Partnership is a general partnership that has chosen LLP status with the state. This election modifies liability regulation while retaining the basic structure of partnership. The partners are still sharing management power and profit.

The liability protection is what makes LLP’s unique. Usually, partners aren’t personally held responsible for the wrongdoing of other and partners Nonstock. It is highly essential in professional practices.

A Limited Liability Partnership is not taxed at the firm level. The income and losses pass directly onto the partners’ tax returns. This sidesteps taxation at the entity level and eases reporting.

Key Benefits and Legal Structure

A Connecticut LLP offers a number of significant benefits that traditional partnerships do not. These benefits arise from legal protections and operational independence.

Liability Protection Explained

Reduced personal liability is the main benefit of an LLP. In general, partners are protected from each other’s debts. It facilitates working together without excessive risk

Nevertheless, partners remain responsible for their own professional behavior. Having an LLP structure does not relieve one from personal liability.

Management and Control

LLPs do not restrict management like limited partnerships. Everyone involved may take active part in operations. Professional firms with shared management are suited for LLPs.

Voting rights and powers are defined in partnership agreements. When everyone’s on the same page, disputes and misunderstanding don’t happen.

Tax and Financial Flexibility

LLPs are subject to pass-through taxation. Profits and losses are distributed per the partnership agreement. This flexibility accommodates a customized financial arrangement.

corporations taxes are not a burden. Numerous partners value the straightforwardness and clarity of this model.

Common Uses for LLPs

- Professional service firms

- Consulting and advisory groups

- Accounting and legal practices

- Collaborative service businesses

These applications are indicative of the LLP’s flexibility.

Connecticut Limited Liability Partnership Compared to Other Entities

When considering a Connecticut Limited Liability Partnership, people often compare them to LLCs or general partnerships. All the options have different trade-offs.

| Feature | LLP | General Partnership |

|---|---|---|

| Partner liability | Limited | Unlimited |

| Management flexibility | High | High |

| Formation complexity | Moderate | Low |

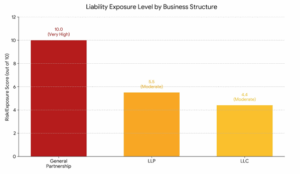

Liability Exposure Comparison

- A Limited Liability Partnership (LLP) reduces risk to a score of 5.5, thereby protecting personal partners from the professional negligence of their other partners.

- The LLC gives all owners an optimal consistent moderate (4.4 score) as a corporate-style shield against general business liability.

- Growing firms are incentivized to convert to an LLP since transformation helps shield personal assets after there is quite a reduction in risk i.e. 4.5 points.

Practical Steps and Considerations

- Partners must review their purpose before forming a Connecticut LLP. Collaborative businesses with shared responsibility suit LLPs well.

- A partnership agreement must be thorough. This should include profit-sharing, decision-making and dispute resolution. Clarity of terms promotes stability

- Continuing compliance required. It is mandatory for LLPs to sustain their registration and fulfill yearly filing requirements. Staying updated keeps your liability safe

Best Practices to Follow

- Draft a comprehensive partnership agreement

- Clearly define partner roles and authority

- Maintain required state filings

- Review structure as the business evolves

Following these practices reduces risk. Preparation supports long-term success.

Is a Connecticut Limited Liability Partnership Right for You?

A Connecticut Limited Liability Partnership is the best option for a business that wants to partner up and share some protection by Corporation Center. It negates joint liability whilst retaining its partnership flexibility. When partners know its structure, they make better choices.

This guide discussed the Connecticut Limited Liability Partnership (CLLP), how it works, its benefits, and how it compares to other entities. We share practical considerations to encourage well‑informed decisions. Knowledge makes things clear.

When partners form and manage a Connecticut Limited Liability Partnership properly, they can focus on growth and service delivery. This structure provides a useful and sustainable framework for many professional and collaborative efforts.