One of the most important decisions that a licensed professional should make when starting a business is to decide which type of legal entity is suitable. The Professional Associations in Alabama offer the doctors, lawyers, architects, and accountants, a set of distinctive benefits. As compared to non-professional corporations or partnerships, professional associations (PAs) are entities that are tailored to the requirements of the licensed professionals who additionally need to have both the safety from the law and a regulated framework for their practice.

An Alabama Professional Association offers both legal safety and professional trust. It enables the people in the regulated industries to work under a formal business structure and at the same time, follow the local rules. If professionals do not form a PA, they will be liable for legal charges and, at the same time, they will not be able to fully use the available financial and structural benefits.

This article explores the fundamentals of Alabama Professional Associations, their benefits, legal requirements, comparisons with other entities, and practical guidance for setting one up successfully.

Understanding Alabama Professional Associations

Alabama Professional Associations are legal entities created under state law to provide services exclusively in licensed professions. They share similarities with corporations but include stricter eligibility and operational requirements.

Key Features of a Professional Association

- Eligibility: Only licensed professionals in Alabama (e.g., physicians, lawyers, engineers) may form or join a PA.

- Limited Liability: Protects members from personal liability for debts and obligations of the association.

- Regulation: Subject to oversight by state licensing boards in addition to corporate governance laws.

- Profit Distribution: Structured to allow income to flow to members in proportion to ownership.

| Feature | Description | Benefit for Professionals |

|---|---|---|

| Membership | Limited to licensed professionals | Ensures compliance with state laws |

| Liability Protection | Shields members from business debts | Protects personal assets |

| Formation Requirements | Filed with Alabama Secretary of State | Provides legal recognition |

| Governance | Similar to a corporation, with officers and bylaws | Ensures operational clarity |

Professional associations structured this way are the most appropriate for a pa system in the field of regulated industries that both need to meet compliance regulations and require legal protection.

Legal and Operational Aspects of Alabama Professional Associations

Creating a Professional Association in Alabama PAs is subject to various initial conditions and continuous adherence to rules.

Requirements for Formation

- Check of Eligibility: Only professionals with valid licenses in the same area of expertise may establish a PA.

- Requirements for the name: The name has to have the words “Professional Association” or an abbreviation officially recognized like “P.A.”

- Articles of Incorporation: Alabama Secretary of State is the place to file them.

- Board Approval: A professional board may demand confirmation for it to be acknowledged as a new formation.

Governance and Management

A professional association must appoint officers and adopt bylaws similar to a corporation. Members share responsibility for governance while also adhering to their professional codes of ethics.

Taxation Rules

Professional associations are generally taxed as corporations but may elect S-corp status for pass-through taxation. This provides flexibility in managing profits and obligations.

Ongoing Compliance

Physician assistants in Alabama have to submit annual reports, pay state fees and keep both corporate law and professional licensing boards in compliance.

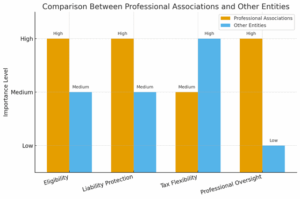

Professional Associations against Other Entities

Professionals often weigh the options of forming a PA, an LLC, or a traditional corporation. Each one of them is characterized by some pros and cons.

PA vs. LLC

An LLC gives the members limited liability companies protection and the possibility to choose their preferred way of taxation, however, in some professions, a PA may still be the only legally allowed form of the organization. As such, PAs are the ones that best fit the requirements of the highly regulated sectors while still putting the emphasis on professional accountability.

PA vs. General Corporation

General corporations can have any individuals qualified as shareholders whereas PAs limit the membership only to licensed professionals. As a result, only people who are qualified and have an influence in business decisions in the backed industries are those which are the regulated ones.

- Professional Associations: High in eligibility and oversight.

- LLCs: High in tax flexibility, medium in oversight.

- General Corporations: High in scalability, low in professional restrictions.

This shows why professional associations are essential in fields that require professional accountability and compliance.

Guide to Forming an Alabama Professional Association

Forming a professional association requires following several key steps.

Confirm Eligibility

Ensure that all members are licensed professionals in the same field.

Choose a Compliant Name – Alabama Professional Associations

Include “P.A.” or “Professional Association” as required by Alabama law.

File Articles of Incorporation

Submit formation documents to the Alabama Secretary of State with required fees.

Obtain Professional Board Approval

Seek confirmation from your licensing board, if required.

Draft Bylaws and Elect Officers

Adopt governance rules and appoint officers to manage operations.

Quick Checklist

- Verify professional eligibility.

- File Articles of Incorporation.

- Gain professional board approval.

- Draft bylaws and elect officers.

Why Alabama Professional Associations Matter

The Alabama Professional Associations framework system delivers to the licensed professionals the protection of their liabilities, gives them credibility, and ensures compliance with the state law at Corporation Center.

By setting up a PA, the professionals provide a shield to their personal assets, secure the procedural framework, and keep up the regulation of the licensing boards. Unlike LLCs or general corporations, PAs have been specially designed to fit the model of sectors where the issue of accountability and control by the professional authorities is of prime importance.

Consequently, a decision made by doctors, lawyers, accountants, engineers, and all other licensed professionals in Alabama to become a professional association is not merely a legal compliance—it is a smart move that keeps their professions and businesses safe for a long time.