In Nevada, the PC is a legal entity specifically for licensed professionals (i.e., doctors, lawyers, architects, accountants, engineers and other licensed professionals) through which the licensed professionals conduct an enterprise that provides limited liability for the shareholders and complies with state licensing laws. A Nevada professional corporation differs from a corporation or LLC in that it permits only licensed professionals to own stock, and only licensed professionals to provide professional services. Nevada attracts professionals interested in forming a legal business entity by offering business-friendly tax laws and privacy laws.

This detailed guide explains what a Nevada Professional Corporation is, how to form one, about the possible benefits and compliance requirements, and how it compares to other business entities.

Understanding the Nevada Professional Corporation

In Nevada, a Professional Corporation (PC) is a corporate entity created under NRS Chapter 89, allowing licensed professionals to incorporate in the state. A PC grants limited liability to shareholders for corporate debts, while maintaining personal liability for malpractice.

Key Features of a Nevada PC

| Feature | Description |

|---|---|

| Eligible Professions | Physicians, attorneys, accountants, engineers, dentists, etc. |

| Liability Protection | Protects shareholders from business debts but not professional malpractice. |

| Ownership | Only licensed individuals in the same profession may be shareholders. |

| Taxation | Can elect C Corporation or S Corporation status. |

Governing Authority under Nevada Secretary of State

Importance of Forming a Corporation

- Licensing Boards: Ensure that businesses comply to be legal for regulated professions.

- Asset Protection: Safeguard personal assets against corporate debts or suits.

- Professional Credibility: Trust results from professional credibility with clients and partners.

- Tax Advantages: Deductions and benefits at the corporate level.

Nevada PCs are also good candidates for professionals looking for liability protection and corporate tax planning benefits.

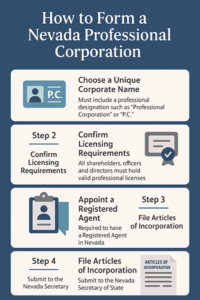

How to Form a Nevada Professional Corporation

Building a Nevada Professional Corporation requires a number of steps to ensure full legal and regulatory compliance.

Step 1: Choose a Unique Corporate Name

The name of your corporation must have a professional designation such as “Professional Corporation”, “Prof. Corp.” or “P.C.” and must not mislead the public about the nature of your business.

Step 2: Confirm Licensing Requirements

Additionally, all shareholders, officers and directors must have valid Nevada professional licenses in the field the corporation provides services for. Thus, a legal pc can only be owned by lawyers.

Step 3: Appoint a Registered Agent

All Nevada PCs must appoint a Registered Agent with a physical Street Address in Nevada who will receive all official correspondence for the PC.

Step 4: File Articles of Incorporation

The Articles of Incorporation for such a Professional Corporation must be filed with the Nevada Secretary of State.

Filing Requirement Details

- However, a filing fee of 75 dollars, which is subject to change, applies.

- Processing often takes between three and 10 business days.

- Filed under the Nevada Secretary of State.

- Has the corporate name, business purpose, registered agent, and licensing information.

Step 5: Create Corporate Bylaws

Bylaws govern how an association operates by specifying who may make decisions and vote.

Step 6: Obtain an EIN (Employer Identification Number)

An EIN is also required for banking, payroll, and tax reporting purposes.

Step 7: Secure Professional Licenses and Permits

Ensure that all state and board licenses are up to date before proceeding.

Legal and Financial Structure of a Nevada Professional Corporation

Nevada PCs are structured like a regular corporation but with some modifications for professionals.

Ownership and Management

- Shareholders: Licensing in the same professional field is a must.

- Board of Directors: Responsible for key business decisions in addition to compliance.

- Officers: Responsible in day-to-day management.

Liability Protection

A professional corporation provides its members with limited liability company for most corporate claims and judgments, but professionals are not protected from malpractice claims and remain liable for their individual acts.

Taxation

Nevada PCs can choose between:

- C Corporation Status: The company pays corporate tax on profits.

- S Corporation Status: Profits go to shareholders’ personal tax returns. Double taxation is avoided.

Tax Options

- A C Corporation has double taxation but may reinvest profits in the business or provide employee benefits.

- An S Corporation has shareholders, is not subject to double taxation, and has simplified financial reporting and accounting requirements.

Nevada Professional Corporation vs. Other Business Entities

| Entity Type | Liability Protection | Ownership Restrictions | Taxation | Best For |

|---|---|---|---|---|

| Professional Corporation (PC) | Business liability only | Licensed professionals only | C or S Corp | Doctors, lawyers, accountants |

| LLC | Full liability protection | Flexible | Pass-through | Small businesses, freelancers |

| Sole Proprietorship | None | One owner | Pass-through | Independent contractors |

| General Corporation (C Corp) | Full protection | Open ownership | Double taxation | Scalable companies |

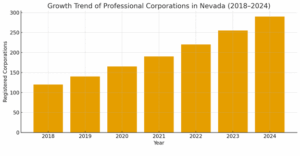

- In Nevada, the number of PCs continued to increase each year from 2018 through 2024 per the graph.

- Registrations grow by the year, showing Nevada’s business-friendly environment continues to gain demand.

- Business formations generally increased from the year 2020.

- The quantity of PCs by 2024 reached a high point, almost twice the quantity in 2018.

- This trend reflects Nevada since professionals seek friendly taxes and easy registration processes.

It notes that many professionals in Nevada incorporate as PCs due to favorable liability and tax laws.

Case Example: A Nevada Law Firm Transitioning to a Nevada Professional Corporation

A group of attorneys from Las Vegas decided to incorporate and organized as a Nevada Professional Corporation, adopting Articles of Incorporation and corporate articles and bylaws in compliance with the State Bar of Nevada’s governance rules, separating their personal assets from the firm’s professional activities and debts.

Results:

- Strengthened asset protection measures.

- Eligibility for professional insurance and corporate benefits.

- Simplified tax structure with S Corporation designation.

According to this case, corporations can further legitimize and structure licensed professional service providers.

Compliance and Maintenance Requirements – Nevada Professional Corporation

After formation, Nevada PCs must continue following Nevada’s business entity laws.

Annual List and Business License Renewal

PCs must file an Annual List of Officers and Directors, and renew their state business license every year.

Requirement Deadline Fee

- Annual List must be filed in the month of the anniversary of incorporation at a cost of 150 dollars.

- The State Business License must be renewed every year at a cost of 200 dollars.

Corporate Recordkeeping

- Keep current records, including:

- Minutes and resolutions of meetings

- Shareholder information

- Financial statements

Professional Compliance

Each shareholder must renew their professional license with the appropriate Nevada board, failing which the PC can be administratively dissolved by the state of Nevada.

Reporting and Tax Filings

- File annual federal and state tax returns.

- Keep business accounts and personal accounts separate.

Practical Tips for Forming a Nevada Professional Corporation

Seek legal advice to ensure that both your profession and your structure comply with NRS.

- Bylaws: define voting rights, ownership, and management responsibilities.

- Stay compliant: Renew licenses. File reports by deadlines.

- Consider Tax Elections: Compare and decide whether to elect to be classified as a C Corporation, S Corporation.

| Tip | Benefit |

|---|---|

| Proper Legal Setup | Avoids formation delays |

| Accurate Records | Ensures transparency |

| Regular Renewal | Maintains active status |

| Tax Strategy Planning | Reduces tax liability |

Advantages of Establishing a Nevada Professional Corporation

- Limited Liability: Protection from non-malpractice-related debts and lawsuits.

- Improved Professional Image: Increases credibility when clients and regulators interact.

- Tax Flexibility: You can tax corporate income or income through a pass-through.

- Perpetual Existence: The corporation continues regardless of the owners.

- Asset Management: Easing transfers and profit-sharing.

These advantages make incorporating a professional service business in Nevada potentially one of the most helpful.

Strengthening Professional Practices through Incorporation

Corporation Center combines liability protection with credibility and efficiency and is ideal for providing professional services on a long-term basis. A PC combines all the benefits of liability protection with improved compliance for regulated professions.

Joining these two obligations becomes important to ensure that your corporation remains both a legal, and financially viable entity. If you are a professional based in Nevada and wish to establish a secure, professional, and efficient business structure, the Professional Corporation is the right option.