When starting a business in Georgia, a common question is which Georgia business structure is best for your business. The most popular choice is the Georgia corporation business structure due to its liability protection, credibility, and business expansion potential. Incorporation in Georgia separates you legally, prevents personal liability, and can open up new investment prospects.

A Georgia corporation is a perpetual business entity, meaning that the business will continue to run even if the owners change. Without being a corporation, owners are personally liable of the business’s debts, which reduce their ability to grow the business.

Understanding the Georgia Corporation

A Georgia corporation is formed under Georgia law as a separate legal entity independent of its owners (the shareholders) and has the capacity to enter contracts, own and transfer property and incur liabilities.

Key Features of a Georgia Corporation

- Separate legal entity: The owners exist separate from the business.

- Limited Liability: Shareholders have no liability for corporate debts.

- Shares provide ownership: Stockholders own the corporation with shares.

- Perpetual Existence: Operations continue regardless of ownership changes.

| Feature | Sole Proprietorship | LLC | Georgia Corporation |

|---|---|---|---|

| Liability Protection | None | Limited liability | Strong liability protection |

| Tax Treatment | Personal income tax | Pass-through or corporate tax | Corporate or S-corp options |

| Ownership | One individual | Members | Shareholders with stock |

| Formalities | Minimal | Moderate | High (bylaws, meetings) |

Legal and Operational Aspects

State law holds Georgia corporate entities accountable. These entities are subject to reporting requirements, governance, and rules.

Formation Requirements

- Choose a Name: The name must include the word “Corporation” or “Incorporated” or abbreviation.

- File Articles of Incorporation: Incorporate by filing the Articles with the Georgia Secretary of State.

- Appoint a Registered Agent: Must have a physical address within Georgia.

- Draft Corporate Bylaws: Outline procedures for management and rights for shareholders.

- Issue Stock: Shares go to original shareholders.

Governance

A stockholder-elected board of directors supervises corporate affairs under officers who determine policies and are managed.

Taxation Options

Georgia corporations can elect for treatment as C-Corporations subject to double taxation, or as S-Corporations subject to pass-through taxation, provided they qualify.

Ongoing Compliance

Corporations are also required to file annual registrations with the Secretary of State, keep records of meetings, and report taxes.

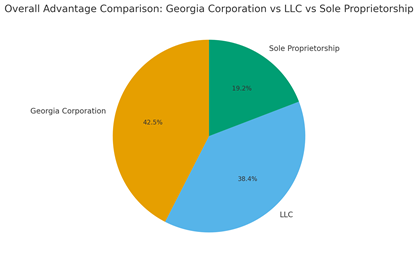

Comparing Georgia Corporations with Other Entities

The differences may motivate entrepreneurs to choose a partnership instead of a corporation.

Corporation vs. LLC

LLCs allow for more flexibility and offer pass-through taxation, but may provide less credibility than a corporation and have limited ability to raise capital.

Corporation vs. Sole Proprietorship

While sole proprietors are easy to form, unlimited liability limits their ability to protect their assets, but corporations are more difficult to form.

- Georgia Corporation: High in liability protection and scalability, medium in formality.

- LLC: High in flexibility, medium in liability protection.

- Sole Proprietorship: High in simplicity, low in liability protection.

This demonstrates why corporations are favored for growth-focused businesses.

Step-by-Step Guide to Forming a Georgia Corporation

Forming a corporation in Georgia involves several clear steps.

Select a Name

Check your state’s requirements regarding name availability and compliance.

File Articles of Incorporation

File with Georgia Secretary of State and pay applicable fees.

Appoint a Registered Agent

Select a skilled individual to handle legal documents.

Draft Bylaws and Issue Shares

Govern the rules for setting and distribute ownership among shareholders.

Hold Organizational Meeting

Select directors, accept bylaws, and give stock certificates.

Why Choose a Georgia Corporation?

The corporation center provides limited liability, legitimacy, perpetuity, the ability to raise capital and grow and asset protection against personal assets. While there are stricter requirements than with LLCs and sole proprietorships, the benefits are more important.

If your intent is to create a large scaled business, then incorporating as a corporation in Georgia provides the structure, legal protections, and credibility to take your business to the next level.