A Florida General Partnership, which is one of the simplest and most traditional ways to conduct a business, is a business form utilized by two or more owners, also known as partners. A Florida General Partnership is created when two or more persons come to an agreement to conduct a business for a profit, be it a written or implied agreement. Many entrepreneurs prefer this structure due to its simplicity, low cost of starting, and limited formalities. Yet, this ease of formation comes with the important duties which every partner must know.

Florida’s general partnership laws dictate how partners share profits and manage operations as well as liability issues among partners. A general partnership doesn’t create a separate business entity, which means there’s no protection between the business and personal assets like there is with corporations or LLCs.

This manual explains Florida General Partnerships in detail. This encompasses the manner in which they function, along with their benefits and drawbacks, and how they stack up against others. You will find useful instructions to help you assess whether this type of partnership model suits your requirements.

Understanding Florida General Partnerships

Florida General Partnerships are where two or more partners own and run a business together. Every partner provides an amount of resources like money, skill, labor, etc. Unless you agree otherwise, profits and losses are shared equally.

A notable aspect of this system is shared management. Each partner has the power to conduct affairs of the firm. Decisions made by one partner can legally bind the others. This requires a lot of communication and trust.

In Florida, general partnerships exist automatically and do not have to register with the state. Nonetheless, they may elect to register a partnership name or submit other documentation. Even if no filings are made, the partnership is legally effective upon commencing business.

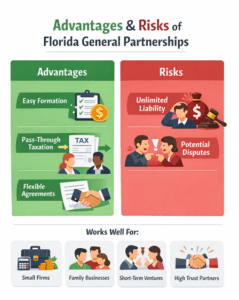

Advantages and Risks of Florida General Partnerships

While there are advantages to establishing a General Partnership in Florida, there are also disadvantages. Weighing both sides aids partners to make informed decisions.

Advantages of a General Partnership

Formation of general partnerships is easy. The start-up costs are minimal, and there are few formal requirements. Small businesses or ideas can experiment with this due to its appeal.

Tax treatment is simple. Profits and losses are reported on partners’ personal tax returns. This prevents the double taxation that affects some others.

Another benefit is flexibility. Partners can agree informally about who is responsible for what or make a written agreement. This adaptability supports dynamic processes.

Risks and Liability Concerns

Unlimited personal liability is the greatest risk. Each partner is personally liable for the debts and obligations of the partnership. All partners can be affected by one partner.

Conflicts may occur even in absence of an agreement. Oral agreements can result in misinterpretations or disputes. Written agreements aid in managing expectations.

Common Situations Where Partnerships Work Well

- Small professional service firms

- Family-owned businesses

- Short-term business ventures

- Businesses with high trust among partners

Understanding both benefits and risks is critical. The simplicity of Florida General Partnerships requires careful consideration.

Florida General Partnerships Compared to Other Business Structures

Choosing a Florida General Partnership often involves comparing it to LLCs or corporations. Each structure offers different levels of protection and formality.

| Feature | General Partnership | LLC |

|---|---|---|

| Formation complexity | Very low | Moderate |

| Personal liability | Unlimited | Limited |

| Management flexibility | High | High |

| Ongoing compliance | Minimal | Moderate |

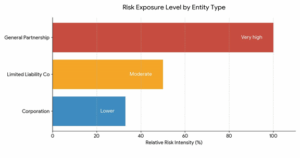

Risk Exposure Comparison

- With the General Partnership’s maximum Personal liability, partners are at a Very High risk level because they are responsible for the whole debt and liability incurred in the business.

- A Limited Liability Company (LLC) minimizes the business risks of a company as it approves detaching business assets from personal assets. This is essential for growing businesses.

- The strongest protection of your assets: Corporate entities possess the lowest risk exposure. Their corporate veil has been tried and tested throughout years of litigation. Moreover, the law protects the owners and shareholders.

Practical Tips for Forming and Managing a Partnership

Florida general partnerships are easy to form, but planning is important. We strongly recommend a written partnership agreement. It clears out powers, profit sharing and dispute resolution.

Partners should clearly state decision-making power. This stops confusion when major decisions occur. Clarity improves trust and efficiency. Keep future growth and risk exposure in mind. If the business grows, switching to another business structure may be a good idea. Correct alignment of structure with goals is achieved through periodic reviews.

Best Practices to Follow

- Draft a clear partnership agreement

- Define profit and loss sharing

- Establish dispute resolution procedures

- Review structure as the business grows

Following these practices reduces misunderstandings. Preparation strengthens long-term stability.

Are Florida General Partnerships Right for You?

The Florida General Partnership is an excellent business structure option for business owners with a great deal of trust. It’s easy to form and has fewer formalities. They are ideal for smaller businesses, professionals, and short-term assignments. Before choosing this structure, one ought to know both benefits as well as risks.

Choosing Corporation Center and careful planning will allow business owners to run their business efficiently and with less conflict. In the right circumstances, such a structure provides a practical and flexible foundation.