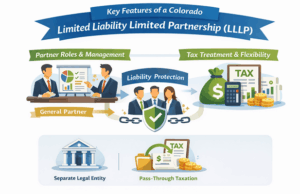

A Colorado Limited Liability Limited Partnership is a special type of partnership that offers the flexibility of a partnership with limited liability. A Colorado Limited Liability Limited Partnership allows partners to participate in management while shielding their personal assets from business debts. Investment groups, family businesses and other firms requiring one form of partnership taxation plus additional protection often choose this structure.

In traditional limited partnerships, general and limited partners are separated. This often causes general partners to face unlimited liability exposure. , Limited liability limited partnerships were problematic in a handful of states, including Colorado, which also addressed liability issues. Due to its appeal, it’s ideal for complicated enterprises requiring multiple men to conduct, manage and plan.

Colorado limited liability limited partnerships are discussed in this guide. This explains how they operate, why businesses use them, and how they compare to other forms of partnership and entity. Tips are provided for assessing whether this framework is right for your operations and risk profile. When you are all done, you will know exactly how Colorado Limited Liability Limited Partnerships work and when they might be most effective.

Understanding Colorado Limited Liability Limited Partnerships

Colorado Limited Liability Limited Partnerships are simply a better limited partnership. A partnership with one or more general partners and one or more limited partners. In contrast to traditional limited partnerships, general partners are provided with liability protection.

This allows for partnership-style management and flow-through taxation. It also protects the partners from being personally liable for most business debts. Creditors usually can’t go after personal assets for partnership debts.

You create the entity by submitting the requisite formation documents to the state. Once formed, it functions as a separate legal person. Clear documentation enhances credibility and enforceability.

| Feature | Colorado LLLP |

|---|---|

| General partner liability | Limited |

| Limited partner liability | Limited |

| Separate legal entity | Yes |

| Pass‑through taxation | Yes |

Key Features and Legal Structure

Under state laws, partnerships govern Colorado Limited Liability Limited Partnerships. They set out the rights, responsibilities and protections of all partners. Following rules and regulations are important.

Partner Roles and Management

General partners oversee day to day operations. The partners in most partnerships are not personally liable for partnership debts. It encourages engagement without significant danger and risk.

Limited partners usually invest money. The partnership agreement dictates whether they have voting/advisory rights. They are liable for their own investment.

Liability Protection Explained

Liability protection for all partners is the hallmark of this structure. These protections cover contract debts and obligations. Personal misconduct and guarantees are still subject to liability.

This protection lets businesses grow while shielding partners’ personal assets. This is especially useful in investment projects.

Tax Treatment and Flexibility

In general, Colorado Limited Liability Limited Partnerships are pass-through entities. Gains and losses go directly to the partners’ tax return. This prevents levying taxes against entities.

Profits can be allocated flexibly by the partners in a partnership agreement. This aids in unique financial agreements between partners.

Common Uses for This Structure

- Real estate investment groups

- Family-owned investment partnerships

- Professional investment ventures

- Asset-holding entities

Use cases show versatility of the structure. The design is for collaborative ownership at lower risk.

Colorado Limited Liability Limited Partnerships Compared to Other Entities

Often, businesses compare Colorado Limited Liability Limited Partnerships to LLCs or traditional limited partnerships. There is variation in benefit with structure.

| Feature | LLLP | Traditional LP |

|---|---|---|

| General partner liability | Limited | Unlimited |

| Management flexibility | High | Moderate |

| Liability protection | Strong | Partial |

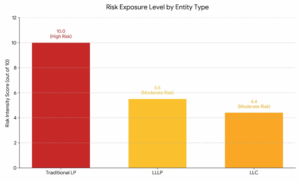

Risk Exposure Comparison

- The general partners are liable for all the debts and obligations of the partnership. It has the highest risk score of $10.0$.

- The advantage of LLLP is that the risk drops to Moderate ($5.5$) when the status is of an LLLP because liability is extended to general partners, like limited partners.

- The LLC carries the least risk in this group (4.4), offers a strong shield to all members and is widely used for risk-averse business planning.

Practical Considerations Before Forming

Before creating a Colorado Limited Liability Limited Partnership, think about your objectives. This works optimally when the venture is organized with several investors and management.

Draft a detailed partnership agreement. The roles and profit allocation and decision-making authority are defined in this document. Clear terms lower conflict

Meanwhile, preparation for compliance. Filing and keeping of records yearly. When you’re organized, you won’t have any penalties.

Best Practices to Follow

- Define partner roles clearly

- Use a comprehensive partnership agreement

- Understand liability limits and exceptions

- Review structure as the business grows

Following these practices supports effective governance. Preparation reduces future challenges.

Is This Structure Right for Your Business?

Corporation Center Limited Liability Limited Partnerships provide both operational flexibility, and personal liability protection for partners. They are suitable for investment and collaborative ventures. Understanding the structure helps business owners to make confident decisions.

This guide explains Colorado Limited Liability Limited Partnerships, their benefits, and how they stack up against other entities. Informed planning was supported through shared practical considerations. Knowledge mitigates risk and uncertainty.

When businesses choose this structure thoughtfully and maintain proper compliance, they can protect the partners. The business also retains operational flexibility. A Colorado limited liability limited partnership may be the right foundation for your venture to grow and succeed long term.