A California Professional Corporation is a type of corporation designed for licensed professionals who want to conduct business through a corporation. The California Professional Corporation provides an opportunity for qualified individuals to provide professional services while meeting State licensing and ownership requirements. Doctors, lawyers, accountants, architects and other licensed professionals often select this structure to formalize their practice and facilitate growth in the long run.

According to California law, most licensed professionals can’t operate as a corporation or standard LLC. The state mandates a Professional Corporation to secure accountability, ethical standards, and regulatory oversight. The arrangement of the business manages professional responsibility. It protects owners from liability but imposes other specific requirements.

The California professional corporation is detailed in this guide. The particulars of what it is, who can form one, how it differs from other entities, and what to consider before formation are discussed. When we finish, you will know whether a California Professional Corporation is the right structure for your licensed practice and your long term goals.

Understanding the California Professional Corporation

A California Professional Corporation is a corporation specially designed for licensed professionals. The California Corporations Code as well as the rules of the relevant licensing board govern it. Only persons with the necessary professional licences are permitted to own shares or provide services.

This arrangement permits experts to work under a business name while complying with the law. The corporation is a separate legal entity and distinct from its shareholders. Nonetheless, this liability for service usually rests with the professional.

Professional Corporations are often used in regulated sectors. The structure ensures that professional decision-making is in qualified hands. It protects the public to maintain professional standards.

| Feature | California Professional Corp |

|---|---|

| Designed for licensed services | Yes |

| Shareholder license required | Yes |

| Separate legal entity | Yes |

| Personal liability for services | Yes |

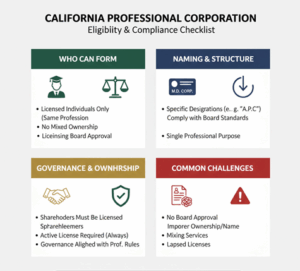

Eligibility and Legal Requirements

The eligibility rules for forming a California Professional Corporation are stringent. These obligations ensure that professional services remain regulated and ethical.

Who Can Form a Professional Corporation

A Professional Corporation may be formed or owned only by individuals licensed in the same profession. Medical corporation must be licensed physicians must be owners. In general, mixed ownership across professions is prohibited.

Licensing boards are a vital element. Many professions need approval or certification before or after incorporation. Follow the rules of the board.

Naming and Structural Requirements

The name of the corporation must include certain professional designations. The terms indicate the entity offers regulated professional services. Names should also meet licensing board requirements.

One professional purpose only should be served by formation of corporation. You can’t offer services unrelated to your work. These ensure concentration and regulatory clarity.

Governance and Shareholder Rules

Shareholders should maintain an appropriate license at all times. If a license gets suspended or revoked, the owner may have to change it. This requirement helps uphold public trust.

Directors and officers generally have other professional competencies required. Governance should be according to state professional regulation and not corporate law.

Common Compliance Challenges

- Failing to obtain licensing board approval

- Improper ownership structure

- Using a noncompliant business name

- Mixing professional and nonprofessional services

If understood early, it can save unnecessary delays and penalties.

California Professional Corporation Compared to Other Entities

On many occasions, licensed professionals give a comparison of a California Professional Corporation with LLCs or regular corporations. The laws of the state restricts options available to you.

| Feature | Professional Corp | Standard LLC |

|---|---|---|

| Allowed for licensed work | Yes | Usually no |

| Ownership restrictions | Strict | Flexible |

| Professional regulation | High | Low |

| Liability for malpractice | Personal | Personal |

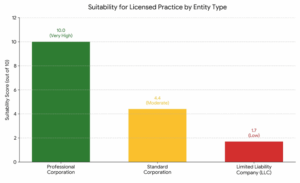

Structural Suitability Comparison

- The Professional Corporation (PC) earns a perfect 10.0 suitability score because it serves licensed practitioners who want to meet their profession’s regulatory and liability requirements.

- The Compliance Gap: A Standard Corporation will offer only moderate suitability ($4.4$) and will often lack the right legal frameworks that state licensing boards for professional services require.

- In light of the above-mentioned factors, the Limited Liability Company structure receives a Low $1.7$ and most jurisdictions limit or heavily regulate the use of standard LLCs for professional practices, such as law, medicine or accounting.

Practical Considerations Before Forming

Verify that you can obtain a license before you form a California Professional Corporation. Every profession has some rules and approval system. Verify early, save time.

Weigh your liability risk. More and more, corporations help protect professionals from lawsuits that stem from administrative actions. But that protection does not help when it comes to professional malpractice. Planning for Insurance is essential.

Prepare for changes in authority and control. A change of licensing status can affect ownership. Planning ensures continuity.

Best Practices to Follow

- Confirm licensing board requirements early

- Choose a compliant corporate name

- Maintain active professional licenses

- Plan for ongoing reporting and compliance

Following these practices reduces regulatory risk. Preparation supports long-term stability.

Is a California Professional Corporation Right for You?

Numerous licensed professionals require and trust the California Professional Corporation structure or option. This ensures business processes with serious cognitive screening oversight. A better grasp of its rules can help professionals conduct themselves with confidence.

A California professional corporation is a form of corporation that offers limited liability protection to its shareholders. We shared practical considerations to help you make informed decisions. Knowledge Minimizes Compliance Risks

A California Professional Corporation Center, formed properly and thereafter complying with regulatory standards, frees professionals to deliver service with confidence. The structure strengthens credibility, provides organization, and leads to the longevity of regulated sectors.