Medical doctors, lawyers and accountants are professionals who typically need customized business structures that can fulfill legal and moral standards. In Arizona, the establishment of an Arizona Professional Corporation is the way to go as it guarantees conformity with the state laws while still providing the shield of liability and the trust factor. This kind of legal entity is different from the regular companies in that the ownership and management are by those professionals who are licensed and belong to the same field only.

While the creation of a professional corporation results in benefits such as tax advantages, well-organized governance, and increased client trust, it also comes with more detailed filing requirements, ownership rules, and compliance obligations. This handbook touches on the fundamentals, demands, contrasts with other business entities, and guidance for the successful setting up of an Arizona Professional Corporation.

Overview of Arizona Professional Corporations

Arizona Professional Corporation is designed for licensed professionals who want to operate as a business while retaining personal liability protections.

- Restricted Ownership: Only licensed professionals in the same field can be shareholders.

- Legal Compliance: Formed under Arizona Revised Statutes governing professional entities.

- Limited Liability: Protects personal assets from corporate debts, though malpractice liability remains.

- Governance: Managed by a board of directors and officers.

| Feature | Arizona Professional Corporation | General Corporation |

|---|---|---|

| Ownership | Licensed professionals only | Any individual/entity |

| Liability Protection | Yes (not malpractice) | Yes |

| Taxation | Corporate tax rules apply | Corporate tax rules apply |

| Purpose | Specific professional services | Any legal business |

This distinction ensures that professionals maintain industry standards while enjoying the corporate structure’s benefits.

Detailed Aspects of Arizona Professional Corporations

Establishing an Arizona Professional Corporation requires careful attention to specific legal and operational details.

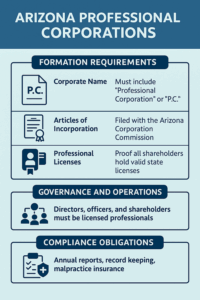

Formation Requirements

- Corporate Name: Must include “Professional Corporation” or “P.C.”

- Articles of Incorporation: Filed with the Arizona Corporation Commission.

- Professional Licenses: Proof that all shareholders hold valid state licenses.

- Registered Agent: Required to receive official correspondence.

Governance and Operations

The company is required to select directors and officers who have a professional license and are professionals. The shareholders are restricted to members of the same profession to maintain ethical and legal standards.

Compliance Obligations

Professional corporations need to submit their annual reports, keep the proper records, and follow the regulations of the Arizona licensing board. It is also necessary to carry malpractice insurance because personal liability for professional negligence recourse cannot be avoided.

The comparison of a professional corporation with other types of business

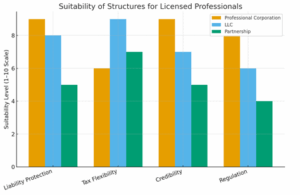

The decision to form the proper entity is indispensable. There are many professionals who consider utilizing a corporate structure versus forming an LLC or a partnership as their best option.

A group of physicians forming a clinic may prefer an Arizona Professional Corporation for liability protection and investor credibility. By contrast, a solo consultant may opt for an LLC for simplicity and flexible taxation.

- Professional Corporation: Strong in liability protection and credibility, with moderate tax flexibility.

- LLC: Best in tax flexibility, good liability protection, but less regulated than corporations.

- Partnership: Weakest overall, offering low liability protection and credibility.

This comparison shows why many licensed professionals choose PCs despite stricter rules, especially when credibility and liability protection are priorities.

Practical Tips for Forming an Arizona Professional Corporation

Navigating the formation process is not that difficult once you have planned and taken care of the details.

Tips for Success

- Confirm Eligibility: Make sure all shareholders are licensed in the right manner.

- Reserve Your Name: Pick a name that complies with the naming rules and has “P.C.” or “Professional Corporation”.

- Hire a Registered Agent: It is mandatory for getting all the official documents from the state.

- Know the Tax Options: Investigate if choosing S-crop tax status will be advantageous for your practice.

Step by Step Guide

- Prepare and submit the Articles of Incorporation.

- Submit license verification for every shareholder.

- Create bylaws and hold the first board meeting to appoint directors.

- Submit annual reports and stay on the right side of the regulatory boards.

Such actions assist the professionals to become a legally sound and operationally secure entity.

The Reason behind Forming an Arizona Professional Corporation

The Corporation Center is the most suitable framework for those who have a professional license. It provides them with the necessary protection from risks that might arise, the trust of their clients, and compliance with the law. Even though it is stricter than other types of entities, its advantages may be more than enough for the majority of professional practices to compensate for the extra obligations.

In case you are a doctor, a lawyer, or a specialist with a license, the establishment of a PC will definitely provide you with the status and safety that you need. It is always a good idea to know the requirements, follow the procedure and then your business will be ready for both, the growth and the compliance. Don’t wait another day to start creating your professional corporation and give your practice the solid support it deserves.