Choosing a legally right structure is essential to be successful when you start a business. One of the best legal forms that many entrepreneurs consider is the Arizona Limited Liability Company (LLC) which is the most flexible and protective of the options. An LLC keeps the business owner’s liability limited and at the same time, the management can still be flexible which is the reason why many small and medium-sized enterprises in the whole state of Arizona choose it.

Business owners who decide to set up an LLC in Arizona become the agents covered with limited liability, i.e., the personal assets are safe from business debts or lawsuits. In addition, there is a pass-through taxation option, which lessens the tax burden that corporations usually face. The risk of the business owner turning into the personal exposure and losing the chance to expand the business is possible if the owner has not set up an LLC or another formal entity.

This piece gives you all the info about creating an Arizona Limited Liability Company. It also talks about the basics, the duties to be fulfilled, the advantages of an LLC as compared to other structures, and some handy tips.

Understanding the Arizona Limited Liability Company

An Arizona LLC is a traded business that combines the limited liability of a company with the ease of operation of a partnership. It is managed according to the Arizona Limited Liability Company Act and essentially should have a filing with the Arizona Corporation Commission (ACC).

Key Benefits of an Arizona Limited Liability Company

- Limited Liability: Keeps the owner’s personal assets safe from the legal obligations of the company.

- Pass-Through Taxation: The company profits and losses are directly allocated to the personal tax returns of members.

- Flexible Management: It is possible to manage by members or by appointed managers.

- Scalability: A company with one owner for a startup or multi-member business is appropriate.

| Feature | Description | Benefit to Owners |

|---|---|---|

| Liability Protection | Members not personally liable for company debts | Safeguards personal assets |

| Tax Treatment | Profits taxed on personal returns | Avoids double taxation |

| Formation Process | Register with ACC and file Articles of Organization | Provides legal recognition |

| Management Options | Member- or manager-managed | Flexible structure |

This framework makes the LLC an attractive option for entrepreneurs who value both protection and simplicity.

Legal and Operational Aspects of Arizona Limited Liability Company

Forming and maintaining an Arizona Limited Liability Company requires compliance with state laws and procedures.

Formation Requirements

- Select a Name: The name must not be similar to any current businesses and must contain either “LLC” or “Limited Liability Company.”

- Submit Your Articles of Organization: Take a file to the Arizona Corporation Commission.

- Hire a Statutory Agent: A registered agent with a physical address in Arizona must be the one to accept service.

- Pay the Required Fees: This is mandatory for the acceptance and processing of the application.

Operating Agreement

While it may not be required by law, an Operating Agreement specifies the rights, duties, and distribution of profits among members. This paper helps to prevent the occurrence of disagreements and ensures the organization is properly managed.

Ongoing Compliance

LLCs are required to adhere to tax filing requirements, must have a statutory agent, and must keep updated records with the state. Annual reports are not mandatory in Arizona; however, any changes in membership or structure must be reported without delay.

Liability and Taxation

Arizona LLCs provide strong liability protection, separating personal and business finances. They also offer pass-through taxation by default, though members can elect corporate taxation if beneficial.

Comparing Arizona Limited Liability Company with Other Business Structures

Choosing between an LLC and other entities depends on the owner’s goals and business needs.

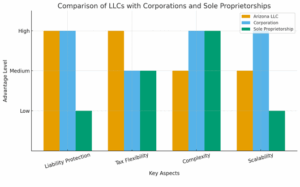

LLC vs. Corporation

While companies enable more solid structures for capital injection, they also have the problem of double taxation and require more formalities. Limited Liability Companies have the advantage of simpler management and more adaptable tax options.

Which is better, LLC or Sole Proprietorship?

A sole proprietorship can be established with minimal effort; however, it does not offer any guarantees in terms of liabilities. Facility owners are shielded by LLCs from the risk of their personal assets and, at the same time, are kept relatively simple.

- Arizona LLCs excel in liability protection and tax flexibility, offering a balanced structure.

- Corporations lead when it comes to scalability and complexity, being a perfect fit for bigger, expanding businesses.

- Sole Proprietorships are characterized by a high level of simplicity and a low score in the safety of the owner’s personal assets, thus being suitable for small, low-risk businesses.

Such a juxtaposition provides insight into the reason why LLCs are the perfect win for the entrepreneurs aiming to strike a balance between safety and adaptability.

Guide to Forming an Arizona Limited Liability Company

Starting an Arizona LLC involves several clear steps.

Select a Name

Ensure the chosen name is unique and complies with state rules.

File Articles of Organization

Submit the required document to the Arizona Corporation Commission, either online or by mail.

Designate a Statutory Agent

Choose a reliable agent with a physical Arizona address to receive legal notices.

Draft an Operating Agreement

Define ownership percentages, voting rights, and profit-sharing structures.

Obtain an EIN

Apply for an Employer Identification Number from the IRS for tax reporting and opening a business bank account.

Why Form an Arizona Limited Liability Company?

An Arizona Limited Liability Company (LLC) at Corporation Center gives the business owners three things: the protection, the flexibility, and the simplicity. The LLC protects the personal assets of the owners, makes taxes easier and adjusts to any size business. When they are in accordance with the state requirements and they are compliant, the owners are guaranteed stability and growth options for the future.

In contrast to corporations or sole proprietorships, an Arizona LLC is the ideal combination of the safety of the assets, the tax advantages and the easy administration of the company. If entrepreneurs are willing to set up a new business or extend their business activities, then one of the most operative ways to lay the foundations of a safe business would be to establish an LLC in Arizona.